Stocks trading

Stock trading involves buying and selling shares of companies listed on a stock exchange, with the goal of profiting from price fluctuations, though all trading carries the risk of losses.

What Is Stock Trading?

Trading a stock means purchasing shares at lower prices, holding them for a period, and selling them at higher prices. This distinguishes it from stock investing, where shares are typically held for the long term.

In stock trading, you can choose to buy actual shares or trade derivatives like stock contracts for difference (CFDs). CFDs allow traders to speculate on share price movements without owning the underlying asset.

What affects stock price?

Stock prices are influenced by a variety of factors that can impact them during trading sessions and over the long term.

Company Fundamentals

This includes financial metrics such as revenues, profits, earnings per share (EPS), and growth prospects. Positive or negative updates on these metrics can significantly affect stock prices.

Market Sentiment

Investor perceptions and attitudes towards a company, industry, or the overall market can sway stock prices. Positive sentiment can drive buying interest and push prices up, while negative sentiment can lead to selling pressure and lower prices.

Economic Indicators

Factors like economic growth rates, interest rates, inflation, and unemployment can influence stock prices. For example, lower interest rates may stimulate economic activity and boost stock prices, while higher inflation could erode purchasing power and dampen investor confidence.

Industry Trends

Developments within specific industries or sectors can impact stock prices. Changes in consumer behavior, technological advancements, regulatory changes, and competitive dynamics can all affect industry outlooks and consequently, stock prices.

Geopolitical Events

Events such as geopolitical tensions, trade disputes, elections, and policy changes can create uncertainty in financial markets and cause volatility in stock prices.

Market News and Sentiment

Events such as geopolitical tensions, trade disputes, elections, and policy changes can create uncertainty in financial markets and cause volatility in stock prices.

Understanding these factors and their interplay is crucial for investors and traders seeking to navigate stock markets effectively and make informed decisions.

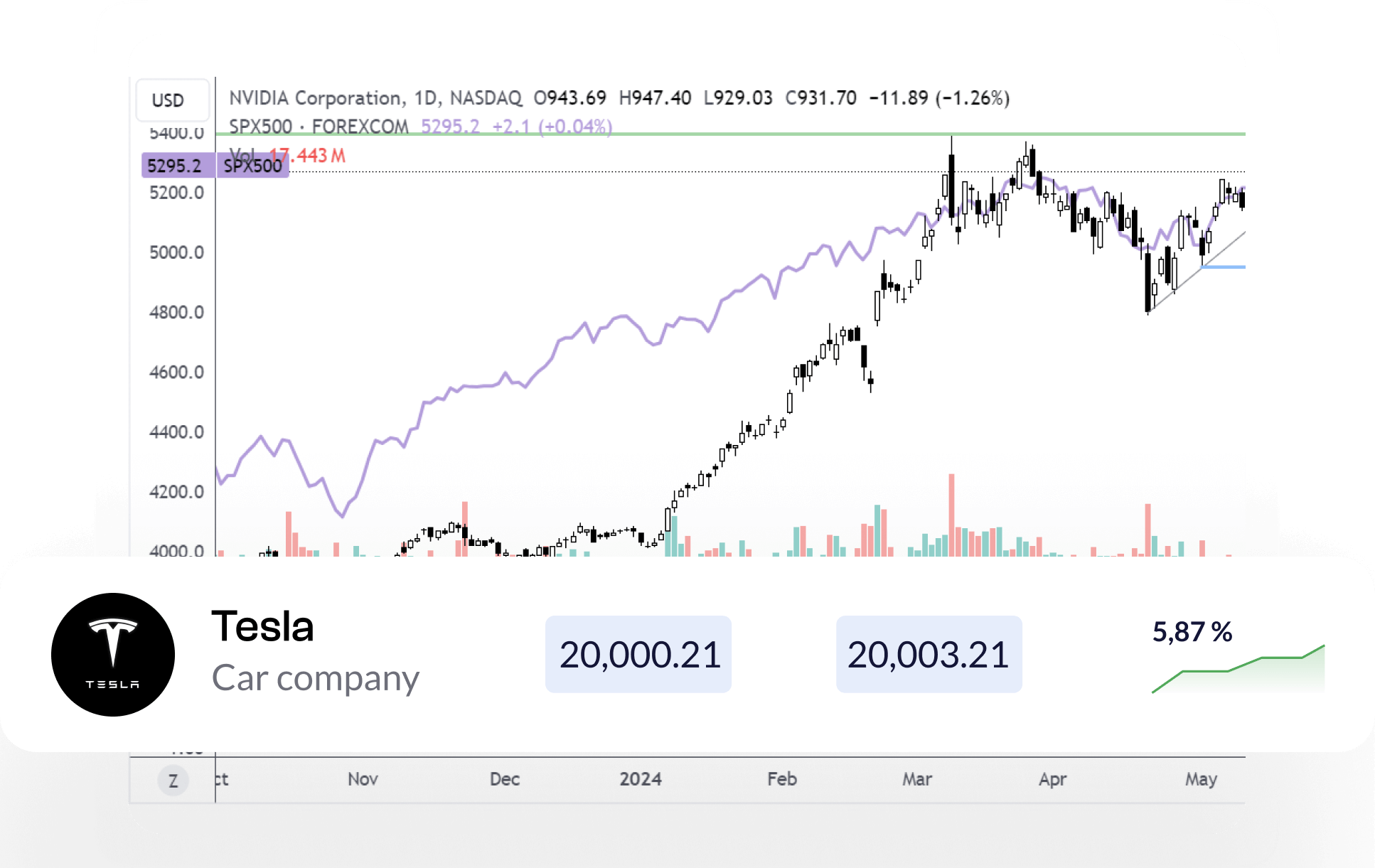

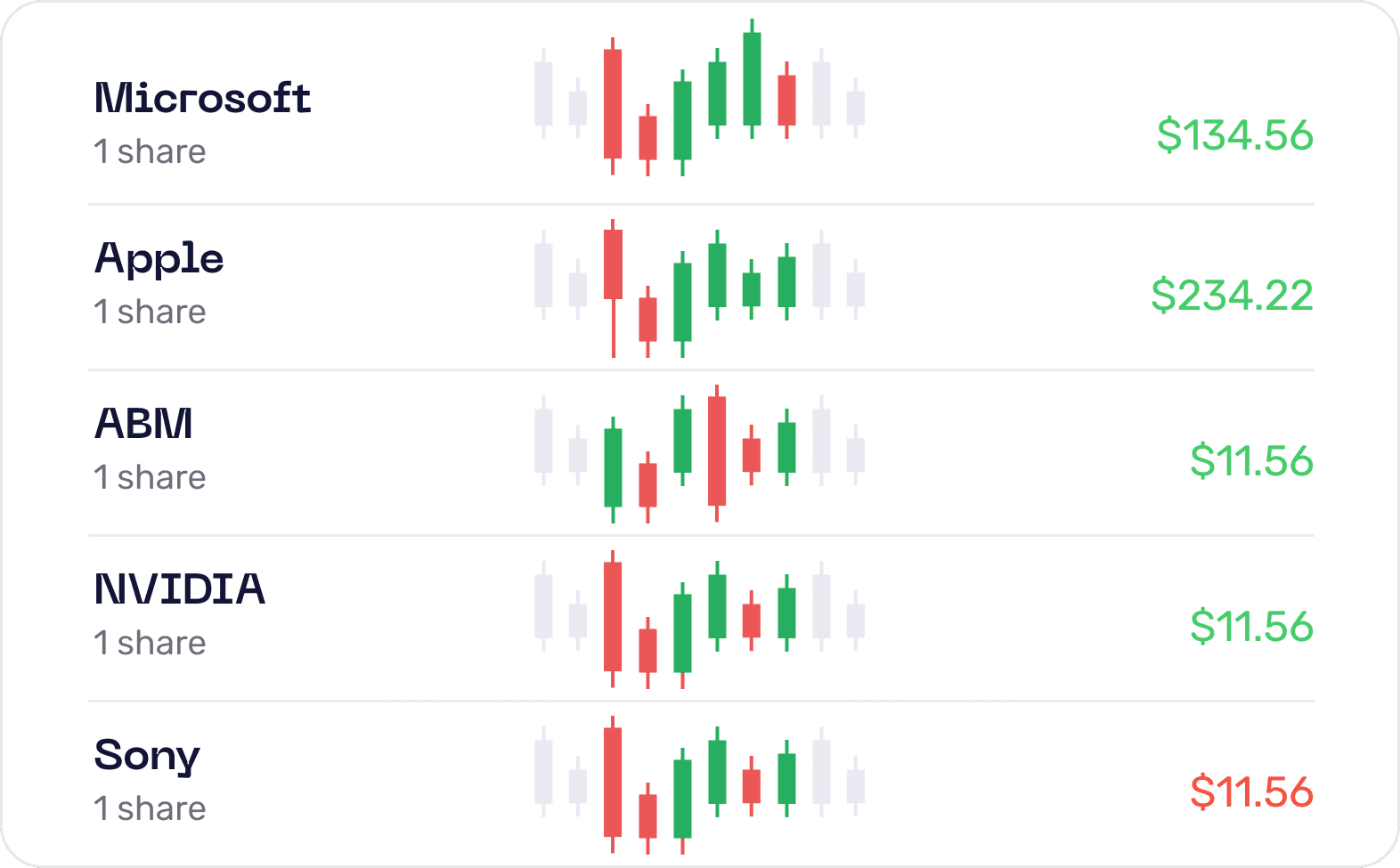

Shares CFDs Trading

Explore specific market sectors through shares CFD trading. Visit our page to discover the full range of shares available for trading. Utilize our interactive table to organize shares by trading volume, volatility, top gainers, and top losers. The table provides real-time prices and displays percentage changes over the past two days.

Why Trade Shares?

Share trading, whether in stock markets or through derivatives like CFDs, remains one of the most popular forms of trading. Join Nfo Capital and start trading shares CFDs online.

Advantages of CFDs on Shares

Trading CFDs on shares offers several advantages:

• Exemption from stamp duty typically associated with traditional share transactions.

• Margin trading capability, which provides leverage and enhances capital efficiency, thereby increasing market accessibility.

• Ability to profit from both rising and falling markets through short selling.

• Leveraged trading magnifies opportunities to capitalize on market movements, allowing for potential gains on smaller price fluctuations.

• Zero balance protection ensures your account balance never drops below zero, managing potential losses effectively.