Trading Basics

Learn the Fundamentals of Trading

At Nfo Capital, we are committed to making trading accessible to everyone. Here are the essential trading fundamentals to acquaint yourself with as you embark on your trading journey.

What is Online Trading?

Online trading involves

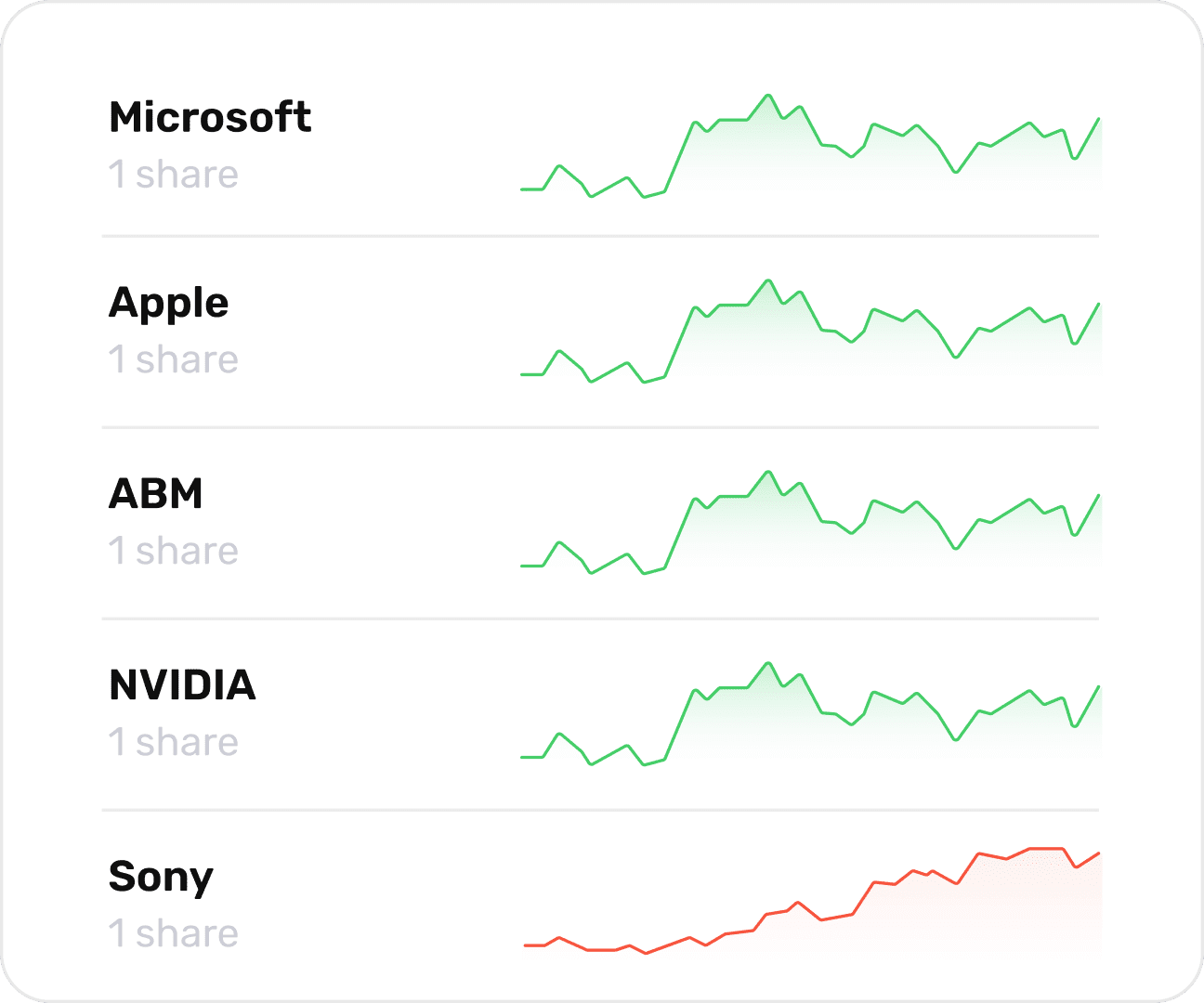

Online trading involves the buying and selling of financial instruments through internet-based platforms provided by brokerage firms. These platforms enable users to execute trades, access real-time market information, and manage their investment portfolios across global financial markets, including stocks, bonds, currencies, commodities, and other securities.

Real-time data

Real-time data, diverse order options, research tools, and risk management strategies are integral components of online trading. Additionally, the 24/7 accessibility of online platforms provides flexibility for traders to respond to market developments across different time zones. Despite its benefits, individuals should approach online trading with an awareness of associated risks, choose reputable platforms, and have a clear trading strategy for a successful experience.

What is a CFD?

A Contract for Difference (CFD) is a financial derivative that allows traders to speculate on the price movements of various assets without owning the underlying asset. It involves an agreement between two parties to exchange the difference in the asset's value from the contract's opening to its closing. CFDs can be based on stocks, indices, currencies, commodities, and bonds.

Traders use leverage to control larger positions with a smaller amount of capital and can profit from falling markets through short selling. However, CFDs do not grant ownership of the actual asset, and margin trading is common, requiring only a fraction of the total contract value. While CFDs provide access to diverse markets and are suitable for short-term trading strategies, they carry high risk, especially with leverage. Traders should be knowledgeable about the market, risk management, and local regulations before engaging in CFD trading.

Why Trade with Leverage?

Trading with leverage allows investors to control larger positions in the market with a smaller upfront investment, potentially amplifying profits. It enables increased market exposure, diversification, and cost efficiency, while also facilitating short selling to profit from falling prices.

However, trading with leverage involves heightened risk, as losses are similarly magnified. Traders may face margin calls, increased volatility exposure, and potential interest costs associated with borrowed funds. It is crucial for individuals to exercise caution, have a deep understanding of the risks involved, and employ effective risk management strategies when trading with leverage.

How to Lower Risk in Trading?

Lowering risk in online trading

Lowering risk in online trading requires a thoughtful and disciplined approach. Start by educating yourself about financial markets and instruments, and diversify your portfolio across various assets. Establish clear goals, set limits for profits and losses, and utilize stop-loss orders for risk mitigation. Exercise caution with leverage, stay informed about market trends, and begin with smaller investments, gradually increasing exposure as you gain experience.

Review and adjust

Regularly review and adjust your trading strategy, choose reputable brokers with transparent practices, and consider using a demo account to enhance skills without financial risk. Controlling emotions and maintaining discipline are crucial for successful risk management, enabling traders to navigate online markets with resilience.

The Mindset of Successful Trading

Trading psychology

Trading psychology is pivotal as it directly influences decision-making and overall success in financial markets. Emotions like fear, greed, overconfidence, and impatience can significantly impact trading behavior. Traders who understand and manage their psychological responses make rational, disciplined decisions, preventing impulsive actions and adhering to a well-defined trading strategy.

Psychology fosters

A robust trading psychology fosters resilience amid market uncertainties, reducing the likelihood of costly mistakes. Ultimately, mastering the psychological aspects of trading is fundamental for consistent and successful long-term performance.