Forex trading

Forex trading, also known as foreign exchange or FX trading, involves trading pairs of currencies with the aim of profiting from fluctuations in their exchange rates.

What is forex trading?

Unlike assets such as stocks and commodities, which are traded on regulated central exchanges, forex trading occurs over the counter (OTC). This means trades are primarily conducted between institutional counterparties in major forex trading hubs worldwide, known as the interbank market.

The largest and most liquid forex trading centers include London and New York, with Tokyo, Hong Kong, Frankfurt, and Singapore also serving as significant hubs.

If you're new to forex trading and want to learn more, continue reading to discover how to get started in this dynamic market.

Forex is the world's most active market

Forex is the world's most active market by trading volume, facilitating nearly $7 trillion in transactions daily, making it the largest market by value.

Due to its global reach, forex trading operates continuously 24 hours a day, excluding weekends. This constant activity plays a crucial role in determining the exchange rates for currencies worldwide.

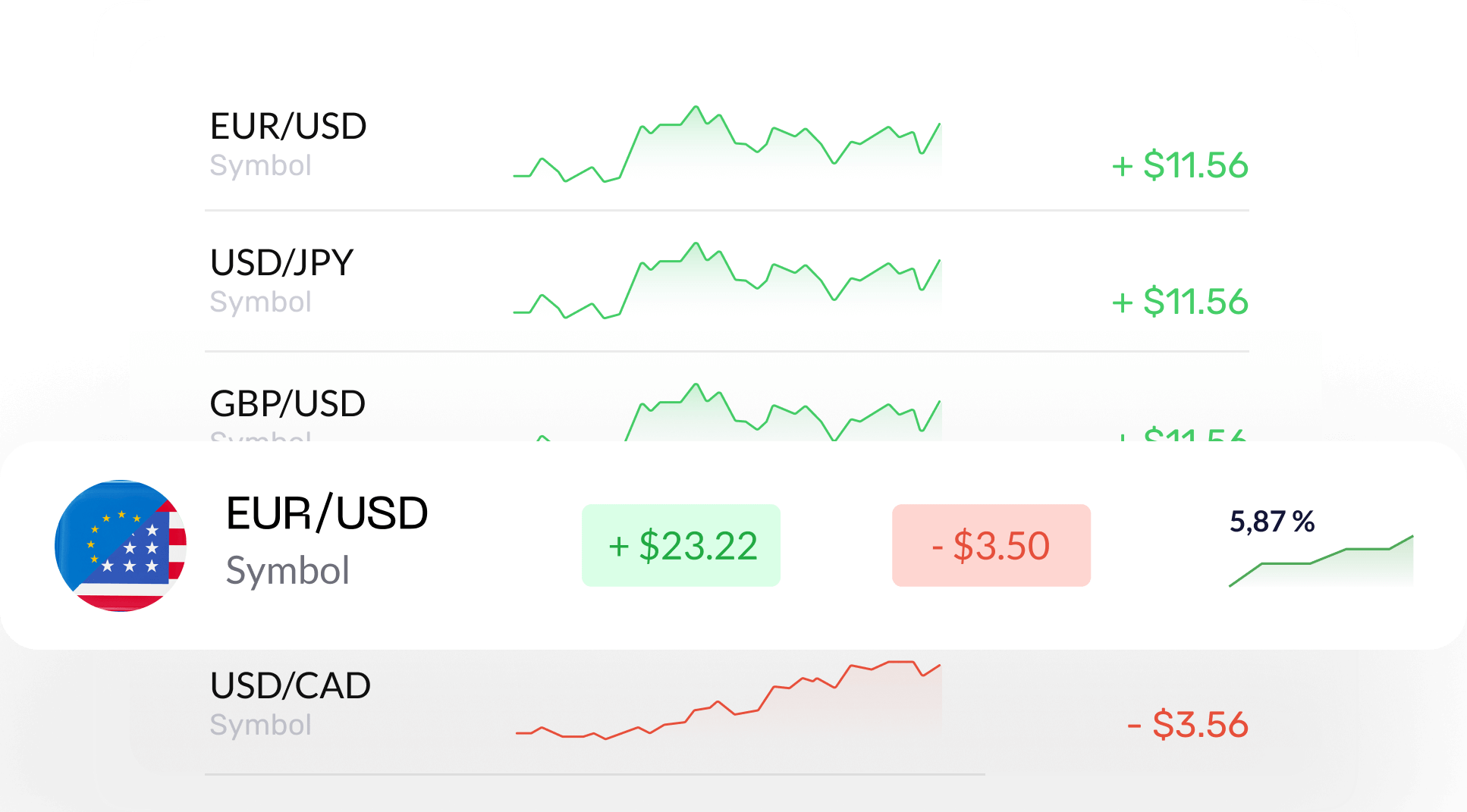

Forex trading involves investors trading currency pairs, evaluating when one currency is expected to appreciate against another.

Major Pairs

These are the most actively traded pairs and offer high liquidity and lower volatility. All major pairs include the US dollar: GBP/USD, EUR/USD, USD/JPY, USD/CHF, USD/CAD, NZD/USD, and AUD/USD. They collectively represent 88% of forex trading volume.

Minor Pairs

These pairs do not include the US dollar and tend to have lower liquidity, resulting in potentially higher price volatility. Examples include EUR/GBP, EUR/AUD, GBP/JPY, NZD/JPY, and GBP/CAD.

Exotic Pairs

Exotic pairs involve a major currency paired with a currency from an emerging market country. They are characterized by low liquidity and high volatility, leading to rapid and unpredictable price movements. Examples include EUR/TRY, USD/HKD, NZD/SGD, GBP/ZAR, NOK/RUB, and AUD/MXN.

Regional Pairs

These pairs are based on regions such as Scandinavia or Australasia. Examples include NOK/SEK, AUD/NZD, AUD/SGD, and CNH/HKD.

Forex trading allows investors to speculate on currency price movements, aiming to profit from changes in exchange rates between different currencies.

Trade Forex CFDs with Nfo.capital

The FX market is renowned as one of the most thrilling and dynamic arenas for traders. Operating 24 hours a day, six days a week, and being the largest global market, it boasts exceptional liquidity. This liquidity ensures swift transactions, allowing traders to buy and sell currencies instantaneously, thereby avoiding trade delays.

Due to its global reach, forex trading operates continuously 24 hours a day, excluding weekends. This constant activity plays a crucial role in determining the exchange rates for currencies worldwide.

Trade forex with leverage

Currencies are available to trade with up to 300:1 leverage. Start trading with as little as $100 to control a position of $30000.

Flexible trading

Trade 24/5 on a wide range of Forex Find potential trades in both a rising and falling markets

Profit and loss control

Easily set Stops* and Limits to automatically close positions at desired prices. Stay informed of significant price movements with personalized price alerts. *Stop loss is not guaranteed